We are the Organization responsible for the major actions of CSR in Banco do Brasil Conglomerate and we are known as its social heart. Organized as a Foundation, our essence towards to life, sensitivity, solidarity, empathy and connection of purposes.

Our action is vital to transform realities where it is most needed, in favor of those at the base of the social pyramid, in situation of vulnerability or social exclusion. We believe in partnerships and the strength of the collective to expand the socio-environmental impact caused in society. We understand the Social Technologies as viable paths and solutions for overcoming social challenges and inequalities, without giving up a sustainable relationship with Nature.

To achieve our purpose, we value diversity, proximity, social sensitivity, effectiveness, integrity and innovation, combined with the principle of sustainability (social protagonism, economic solidarity and environmental care) and among cultural respect. We aim to achieve our vision, being increasingly closer to the communities, relevant and timely in promoting efforts that result in socio-environmental transformation throughout the country.

Banco do Brasil Foundation supports social projects aimed at sustainable development, socio-productive inclusion and reapplication of social technologies. We make non-refundable investments in partnership with local NGOs. Due to brazilian laws, we cannot make any social investment abroad Brazil.

If you want to know about specific actions of volunteering in partnership with Banco do Brasil branches or for further information on how to apply your project for our support, please read our website, only in Portuguese: https://www.fbb.org.br/pt-br/editais-de-selecoes-publicas

Purpose

“Collectively promote paths to social transformation and sustainable relationship with Nature”

Vision

Being increasingly close to communities, relevant and timely in promoting efforts that result in socio-environmental transformation all over Brazil."

COUNCIL MEMBERS

- Tarciana Paula Gomes Medeiros - President of Banco do Brasil and chairman of the Board

- Kleytton Guimarães Morais - President of Banco do Brasil Foundation

- Robert Juenemann - Representative of the Minority Shareholders on the Board of Directors of Banco do Brasil

i – Public Sector

- Ana Cristina Rosa Garcia

- José Ricardo Sasseron

- Gustavo Pacheco Lustosa

- Raimundo Nonato Soares Lima

ii – Private Sector

-

- Camilo Buzzi

- Darllan Rodrigues Botega

- Márcio Antônio Chiumento

- Maria Eugênia Netto de Assis Carvalho Schneider

- - Paula Regina Goto - Representative of the minority Shareholders of Banco do Brasil and Chairman of the Board

- - Alex Pereira Benício - Representative of The Ministry of Finance

- - Charlene Soares da Silva Fiusa - Representative of Banco do Brasil

Executive Board

|

|

Kleytton Guimarães Morais

President

|

|

Luciana Athaíde Brandão Bagno

Executive Director Executive Board for Social Development Management

|

|

|

Gilson Adriano de Oliveira Lima

Executive Director

Executive Board for Human Resources, Comptroller and Logistics Management

|

Managers

Controls, Risks and Integrity Management

People Management

Strategy and Organization Management

Marketing and Communication Management

Information Technology Management

Corporate Systems Team Manager

Monitoring and Evaluation Management

Secretariat and Governance Management

Strategic Partnerships Management

Prospecting and Project Analysis Management

Operational Support Team Manager

Contract Administration Team Manager

Compliance with laws and regulations, external or internal, is the responsibility of management and supervisory bodies, managers and employees in all instances of Banco do Brasil Foundation.

Management Policies and Guidelines, the Code of Ethics of the Employees of Banco do Brasil and the Charter of Conduct of the Organization are used as references in guiding the principles that permeate the conduct of the employees of BB Foundation.

The Institution has always sought to guide its performance in the best practices by including policies that clearly establish limits and lines of operation, such as the Information Security Policy, the Business Continuity Policy and the Investment Policy.

BB Foundation participates with the Brazilian Institute of Corporate Governance (IBGC) and the Group of Institutes, Foundations and Companies (GIFE) in formulating the "Guide to Best Governance Practices for Foundations and Business Institutes", a publication aimed at social investment agents that sets the standards of fairness, transparency, accountability and responsability.

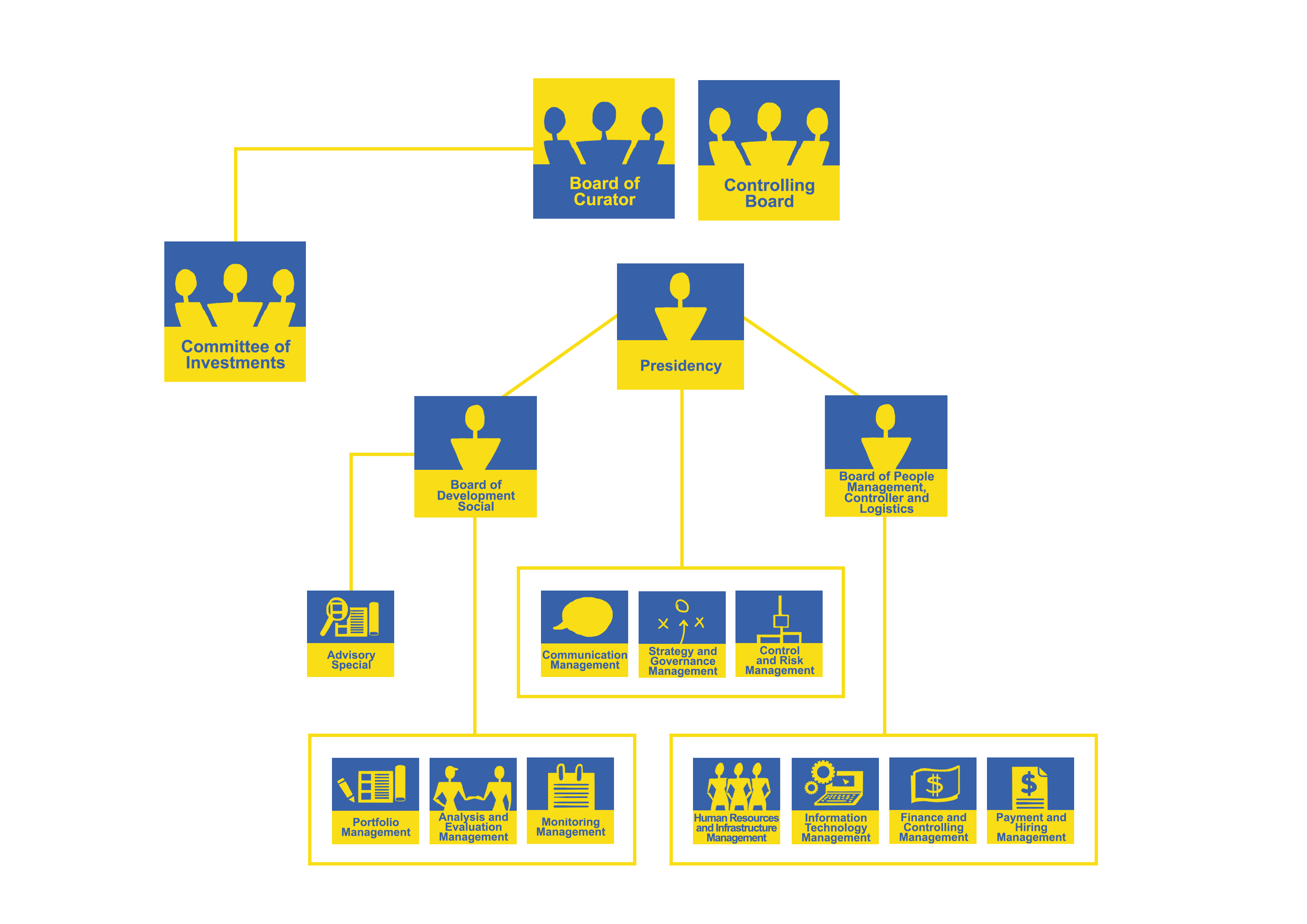

FBB's governance structure seeks to ensure the appropriate division of operational and management responsibilities among its board of directors and audit committee.

- Board of Curators - is the superior body for deliberation and strategic orientation of the Institution.

- Fiscal Board - is the supervisory body for the acts of management of the administrators and activities of BB Foundation.

- Executive Board - is the body responsible for the administration of FBB and compliance with the Bylaws, with permanent action, coordinating and implementing the decisions of the Board of Trustees and other matters of the Organization, as well as taking care of the integration and articulation between the Boards.

Decisions, at any level of the Organization, are taken collectively. In order to involve all managers in defining strategies and operations, the Executive Board uses internal committees that guarantee agility, quality and safety for decision making.

Banco do Brasil Foundation has an Investment Committee to manage the investment strategies for the Institution.. Its purpose is to indicate the Board of Trustees strategies in investing in financial assets through a specific policy.